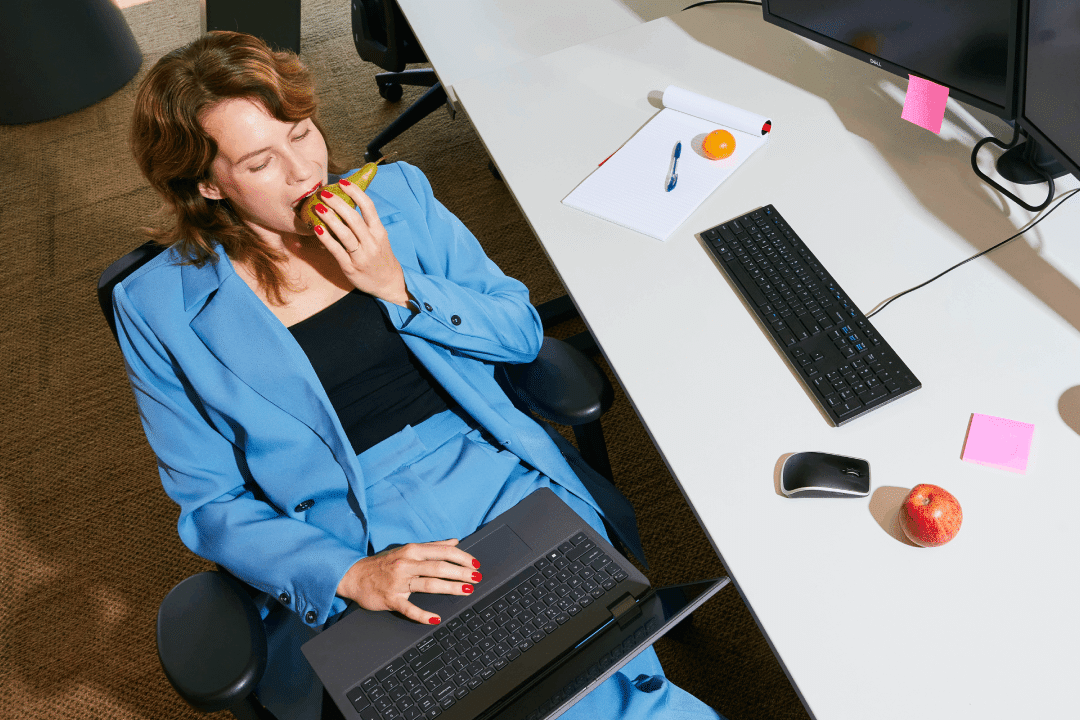

Office fruit: healthy and financially smart

Office fruit isn’t just a healthy choice for your team – it’s also financially attractive for your organisation. By choosing Fruitful Office, you benefit from a tax advantage that tastes just as good as our fruit. More energy on the work floor, while keeping your costs sharp.

How does the tax benefit work?

The Dutch Tax Authority considers office fruit a provision that supports a healthy and vital workplace. That’s why fruit at work falls under the so-called nihil valuation within the WKR (Work-Related Costs Scheme). This means you, as an employer, benefit from:

- No impact on your free space within the WKR

- 100% tax deductible – you can fully deduct the costs of office fruit

- VAT refundable– as long as you stay under the annual threshold

In short: with Fruitful Office you invest in healthier, happier colleagues while saving on taxes. That makes your workplace not just more vital and sustainable, but also financially smarter. Win-win!

Healthy, sustainable and tax-friendly

Nihil valuation

Office fruit falls under nihil valuation – no effect on your WKR free space.

Tax deductible

The costs are fully tax deductible.

VAT refundable

The VAT on office fruit can be reclaimed in full.

Want to know more?

Curious how office fruit can boost vitality and deliver tax benefits for your organisation? Request a free quote or try a free trial crate.

Try free sample crate

Want a taste first? You can. Free and without obligation.

The healthy benefits of our office fruit

FAQs about tax-deductible office fruit

Yes, office fruit is 100% tax deductible in the Netherlands. It falls under the nihil valuation within the Work-Related Costs Scheme (WKR). This means the costs don’t count towards your WKR free space, and both the purchase costs and VAT are fully deductible.

The Dutch Tax Authority classifies office fruit as a nihil valuation. This means it falls outside the WKR free space. You can fully deduct the costs without it affecting other tax-free allowances or benefits.

Yes. The VAT on office fruit is fully deductible. Both the purchase price of the fruit and the VAT can be claimed 100% as business expenses.

No. There are no exceptions. As long as the fruit is provided at the workplace, the nihil valuation applies. Even small businesses and self-employed professionals can fully deduct the costs and reclaim VAT.